After nearly a decade working with the sector to make audience data an essential ingredient in every responsible cultural organisation’s mix, we have learned a lot. Over that time, we have rethought our approach and redesigned our toolkit accordingly.

This month, we relaunch it as Audience Answers to reflect this evolution. Ten years ago, it was all about the tech. Now it’s all about our users.

It IS all about you

Ten years ago, we were at the beginning of a journey, excited by the prospects of what could be done with largescale, shared and integrated data. We were, necessarily, focused on climbing the mountain of technical issues that had to be solved – categorisation, ethics, statistical relevance, software, hardware, licensing, resourcing… I’ll spare you the long list.

And we did solve the tech problems alongside many longstanding mysteries of audience engagement. Questions like – what IS an average catchment area, usual visit frequency, average age of ballet-booker etc – have all been answered and passed into our collective consciousness.

But the more we tested solutions with users, the more we realised the real challenge is not in producing good graphs but in making sure they are the right ones for the moment and in helping people to use them well.

Meaning not metrics

Most organisations in the cultural sector are quite small and brilliantly staffed by creative, highly adaptive and necessarily multi-talented individuals but there is a limit to the specialist research-design and data-wrangling skills they can or should carry. The critical skill they really need is knowing what questions to ask.

And we have more pressing questions about audiences than ever before. We’ve heard again and again about the tightrope many organisations are walking – trying to balance difficult financials with ambitious creative plans and a committed social mission.

As our pandemic research evidenced, the crisis did drive an increase in sector competence and confidence in the use of this kind of insight. Demand continues to grow, however, as we become accustomed to the sustained unpredictability of audience behaviours and trends.

The fresh market analysis we recently published highlights the compounding effects of Covid’s long shadow and the cost-of-living crisis. See, for example, that:

“Over 60% of respondents say that the cost of living is putting them off attending culture events (more than twice that due to Covid concerns), with even higher numbers expecting this to still be the case in 6-24 months' time.”

These compounding challenges put an additional pressure on those trying to develop new strategic plans and business models.

Where Audience Answers comes in

In this complex climate, cultural leaders need to ask direct, practical questions. Which audiences can we rely on and where can we make new relationships? What is the next generation like? Who are our high yielding-bookers? What do they all need? Who are we excluding and what do we need to change? The tools leaders need should answer questions like these as simply and robustly as possible – hence Audience Answers.

Audience Answers is our new suite of audience data and insight services, re-designed to do what our users tell us they need, free of other constraints. We’ve been working on it with users – from organisations of all shapes and sizes – for well over a year. It is a direct response to the tightrope, designed to help organisations navigate the complex challenges ahead, to get the balance right.

As a non-profit dedicated to the cultural sector, we are also building on a decade of providing trusted counsel. The new service intelligently combines ticketing, surveys, Audience Spectrum segmentation, mapping and other population data and following four main design principles:

- Insight into Action

- Users First

- Flexible and Sensitive

- Networked

Insight into Action

What users are telling us is that, while knowing more about their audiences is useful, knowing what action to take next would be even better. This is the first priority that has shaped our new tools and services. Users want:

- Fewer charts and metrics and more actionable insights

- Someone to talk to – not just about getting good data but what to do with it

- Confidence that information is good enough to make decisions on – not just to report to funders

- Clear pointers on increasing revenue AND connecting with under-served communities and tracking other social impact

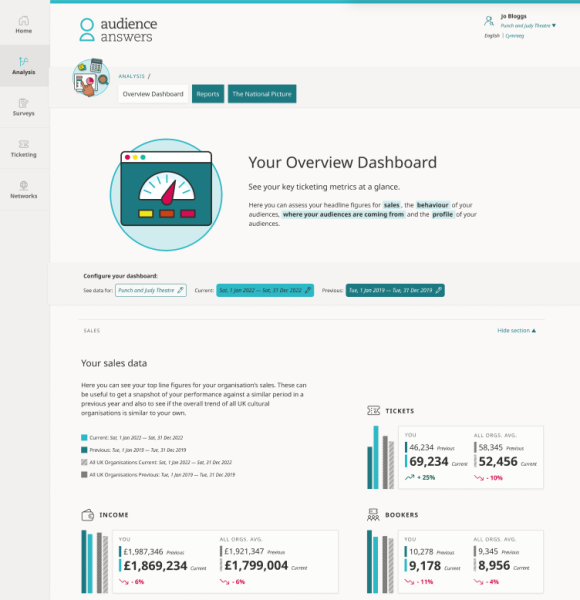

So a main new feature of the service is straightforward advice – in-dashboard and in-person – on the opportunities and implications of insights. We’ve also kept it simple – focusing in on the insights people use most. Importantly, users can be assured of real rigour – from survey design to the critical reoccurring issues like sample size.

Users First

The next principle is always putting ‘users first’. Although our tools are supportive of and 100% compliant with the funding requirements of ACE, Arts Council Wales and Creative Scotland, they are designed primarily to support the practical needs of people using them to inform their day-to-day work.

They are designed, that is, to help organisations make informed decisions, rather than simply as a reporting tool or to build a data set for a funder. We have made the basic hygiene factors of reporting as quick and simple to deliver as possible but have not cut any corners in making tools and insights that go further to help users take practical steps. This includes plenty of face-to-face support and sessions with peers and advisers who know the sector first-hand.

Flexible and Sensitive

We’ve served well over 1,000 users (with Audience Answers’ predecessor tool – Audience Finder) and know just how different needs are. Over the years, we’ve tried hard to flex around those needs despite resource and other challenges. Our new suite reflects that learning and the adaptations we’ve worked with the sector to make – like those for touring companies, outdoors arts, museums, multi-site venues, festivals, networks and many others.

We know there is a huge difference between the needs of different types of cultural organisations of course, but also of differently sized ones, and between programmers, curators, marketers, fundraisers and boards.

Our new suite of services will cater more effectively, in ways we were unable to do while delivering an ACE programme. The new service offers a pick-and-mix of options across three levels:

- A free Snapshot package keeping it quick-and-simple,

- a paid-for Essentials layer of new actionable insights, served-up on an interactive dashboard,

- and a tailored In-depth option, complementing other research and data, with access to The Audience Agency’s team of specialists.

Networked

The last principle is the idea of serving networks more effectively. In our experience working with place-based/other consortia, networks get more value when backed by data.

Many of Audience Finder’s major impacts have been for organisations sharing findings and data expertise through networked groups. Insight to support collaboration was very high on our users’ wish-list for Audience Answers, a fact which has shaped a greatly enhanced service.

More help on the horizon

In short, our legacy Audience Finder service retains many of the features users like best but is more actionable than ever before. Users should discover in the coming months that Audience Answers does exactly what it says on the tin.

Although comprehensive, the services that launch this week are just the start – Audience Answers will continue to grow and improve with the sector, for the sector throughout the coming year. We want to talk to you if any of this is of interest, so do please get in touch.

This article, sponsored and contributed by us, is part of a series sharing insights into the audiences for arts and culture originally published on Arts Professional on 26 April, 2023.